#1: CLICK ON THE BUTTON BELOW TO DOWNLOAD TIGER BROKERS APP AND SETUP YOUR ACCOUNT.

Opting for Tiger Brokers as your brokerage for your initial trade is highly recommended. In this article, we will guide you through every essential step, starting from registration to successfully redeeming your first shares without any cost. At Tiger Brokers, the account opening process is straightforward and doesn’t require any prior expertise. If you have previously opened an account online, you will find the procedure familiar and predictable.

#2: Welcome Reward When You Sign Up To Tiger Brokers

Get free gifts worth up to SGD 410 with an interest bonus boosted to 6%* p.a.. Best place to put your idle cash to work! Plus, AFU members can claim extra USD 20 AAPL shares.

** Note that prevailing promotions may be different for each month.

Promotion Period: 18:00 29/05/2023 – 16:00 30/06/2023(SGT)

Bonus tier

- 1. Sign up and open an account

- Unlimited Commission-Free Trades* for HK & SG & China A Stocks for 365 days

- Unlimited Commission-Free Trades* for U.S. Stocks for 180 days

- 5 Commission-Free Trades* for Options within 30 days

- 3-day 20% yield coupon

- Activate the Auto-sweep feature on Tiger Valut

- Enjoy a 30-day 6% p.a. returns bonus. Limited to the first 5,000 eligible rewards!

- First deposit ≥ SGD (X $ based on focus group session)

- USD 10 of Apple fractional shares (NASDAQ: AAPL)

- First deposit ≥ SGD 1,000 & complete 5 New BUY trades*

- USD 30 of Apple fractional shares (NASDAQ: AAPL)

- 1 sure-win draw attempt (get one free stock, valued between SGD 13- SGD 285)

#3: Tiger Brokers: Revolutionizing Online Securities Brokerage

Tiger Brokers, a Chinese startup based in Beijing, is gaining traction as an innovative online securities brokerage. Backed by influential investors like Interactive Brokers Group Inc (IBKR) and Xiaomi Inc, the company has quickly become a favorite among investors.

Tiger Brokers and its subsidiaries demonstrate their commitment to regulatory compliance, holding 21 licenses and registrations across countries such as the USA, New Zealand, Australia, Hong Kong, and Singapore.

In Singapore, Tiger Brokers (Singapore) operates the Tiger Trade platform, strictly regulated by the Monetary Authority of Singapore (MAS). As a holder of a capital markets services license, the company is authorized to engage in a range of activities, including dealing in securities, collective investment schemes, and exchange-traded derivatives contracts.

At the core of Tiger Brokers’ offerings is their advanced Tiger Trade platform. This platform enables investors to trade equities, ETFs, futures, and stock options across global exchanges, accessible through desktop and mobile devices.

#4: Is Tiger Brokers a Secure Choice for Investors?

When it comes to the safety of your investments with Tiger Brokers, understanding how your stocks are held and the protective measures in place is essential. Your stocks with Tiger Brokers are held in a trust account managed by a custodian bank or brokerage firm. This ensures that your investments are safeguarded.

Moreover, it’s crucial to highlight that Tiger Brokers is authorized and regulated by the Monetary Authority of Singapore (MAS). They have obtained a Capital Markets Service License from MAS, which demonstrates their adherence to industry standards and commitment to protecting investors.

Overall, Tiger Brokers takes the necessary steps to ensure the safety of your investments, with regulatory authorization and adherence to industry standards facilitated by MAS.

#5: Tiger Brokers: Exciting Features for Investors

Tiger Brokers’ Tiger Trade platform offers a comprehensive suite of features to enhance your trading experience. You can trade on major exchanges such as SGX, NASDAQ, NYSE, SEHK, SZE, SSE, and even engage in futures trading. While trading on the London Stock Exchange is currently unavailable, the platform supports both desktop and mobile trading, with the mobile app providing a more user-friendly experience. With multi-currency support and in-app foreign currency exchange service, you can conveniently manage different currencies without conversion fees. Additionally, the platform provides real-time stock quotes, trading charts, data, and in-app stock screening, offering valuable information and research capabilities. Tiger Brokers equips traders with the tools they need for efficient and informed trading.

#6: Competitive Pricing: Tiger Brokers' Fee Structure

Tiger Brokers stands out as a cost-effective choice when it comes to brokerage fees. They offer competitive rates and currently do not charge custodian or account management fees.

Here’s a breakdown of their fees for different markets:

Singapore Equity Fees: Tiger Brokers charges only 0.08% of the share’s value (commission + platform fee) and a trading fee of 0.0075% per trade on the SGX. In comparison, other brokerages often charge a minimum of S$10 for SGX trades.

U.S. Equity Fees: Trading U.S. equities incurs a fee of US$0.01 per share or a minimum of US$1.99 (commission + platform fee) per trade. There is no custodian fee. This competitive pricing puts them ahead of their closest competitor, IBKR.

Hong Kong Equity Fees: For trading on the SEHK, Tiger Brokers charges 0.06% of the share’s value or a minimum of HK$15 per trade. IBKR, their closest competitor, charges slightly higher at 0.08% of the share’s value or a minimum of HK$18 per trade.

China Equity Fees: Tiger Brokers allows trading of Chinese equities on the Shanghai/Shenzhen-Hong Kong Connect, with fees of 0.06% of the share’s value or a minimum of RMB$15 per trade. This option is only available through select brokerages in Singapore, with higher average fees.

It’s important to consider any currency conversion fees when trading in foreign markets. Tiger Brokers previously charged USD$2 for currency conversions but has since waived this fee. Additionally, borrowing funds for trades incurs interest charges.

In summary, Tiger Brokers offers competitive rates with low commission fees across multiple markets. However, be mindful of currency conversion fees and interest charges for borrowing funds.

#7: Signing Up with Tiger Brokers: A Seamless Process

Tiger Brokers simplifies the signup process by integrating with Singpass and MyInfo, making it incredibly easy to get started on their platform.

Smooth Onboarding: By leveraging MyInfo integration, the entire signup process took me just 15 minutes to complete. However, if you don’t have MyInfo, you’ll need to manually upload your documents, which might take a bit longer.

Efficient Approval: After submitting my application on a weekday, my account was approved within an hour, even though the company mentioned it would take a full working day.

Depositing Funds: Currently, Tiger Brokers accepts FAST transfers and Telegraphic Transfer (TT) for depositing funds. I deposited my funds to ANZ bank, and it took approximately an hour for the money to reflect in my Tiger Trade account. Keep in mind that deposits are processed during working hours, so if you deposit funds on a Friday, they will be credited on the following Monday.

Account Types: Once your account is open, you can choose between a paper account, prime account, or upgrade to a margin account. The paper account allows you to simulate trades without using real money, while the prime account provides access to most of the platform’s features. If you’re interested in margin trading, you can open a margin account, which is activated instantly without the need to deposit any funds.

It’s important to note that to comply with Anti-Money Laundering (AML) regulations, funds can only be transferred to an account with the same name. Ensure that your bank account matches the name on your Tiger Brokers trading account.

#8: Tiger Brokers: Reliable Customer Support at Your Fingertips

For any assistance or inquiries, Tiger Brokers provides several channels through which you can reach their customer service team.

Contact Details:

Address: You can get in touch with them at 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623.

Phone: Alternatively, you can reach them via phone at (65) 6950 0591 between 8:30am to 6:30pm.

Email: If you prefer email, you can send your queries to service@tigerbrokers.com.sg.

Online Chat: Additionally, an online chat option is available on both the desktop and mobile applications, operating from Monday to Friday, 8:30am to 6:30pm.

** Please note that customer support is not available during weekends through the online chat or contact number.

Responsive Support: During weekdays, I personally reached out to them with my queries and received prompt replies within an hour on two occasions. This initial experience was positive. However, it’s worth mentioning that some users have reported difficulty accessing customer support outside of the designated working hours. This is an area where improvement is needed.

Overall, Tiger Brokers strives to provide reliable customer support, ensuring that your concerns are addressed in a timely manner.

Frequent Asked Questions

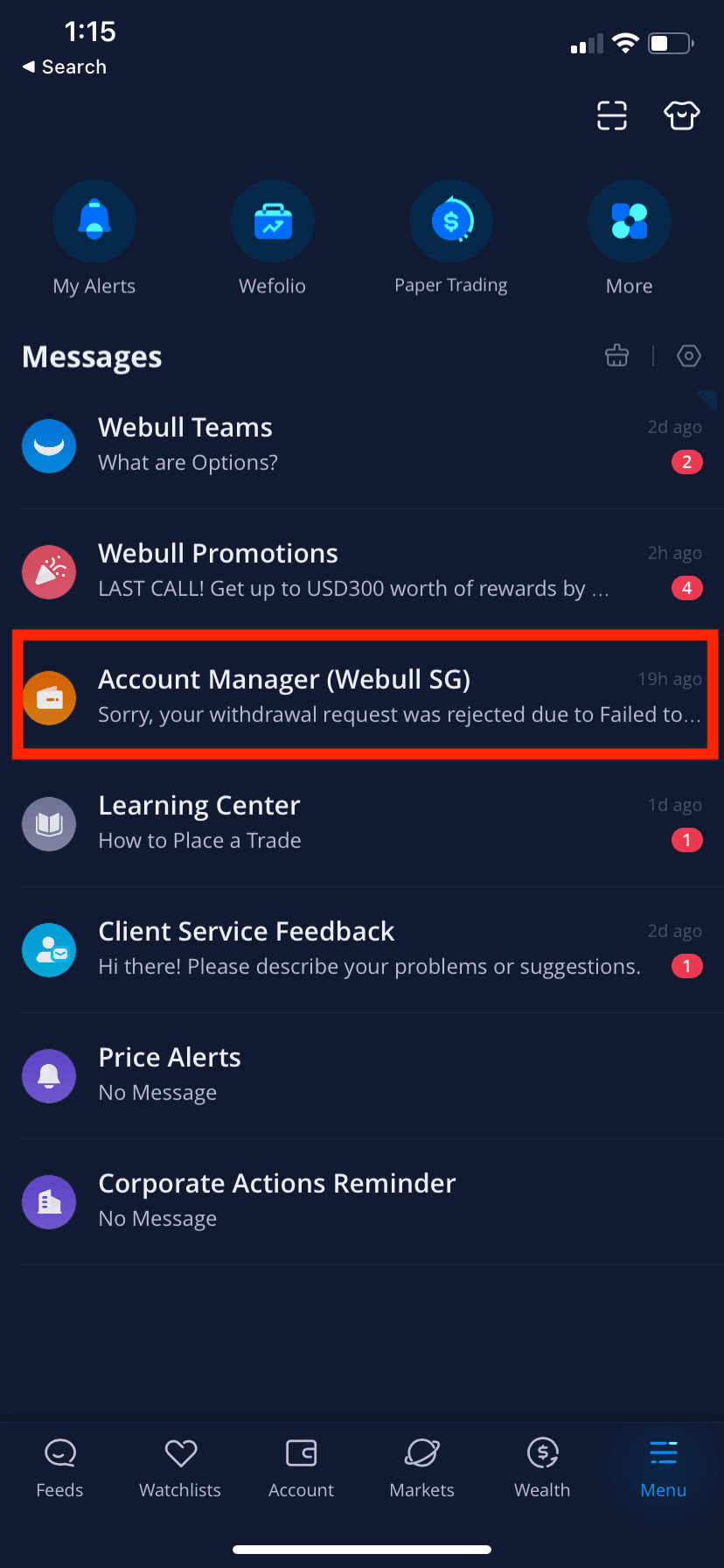

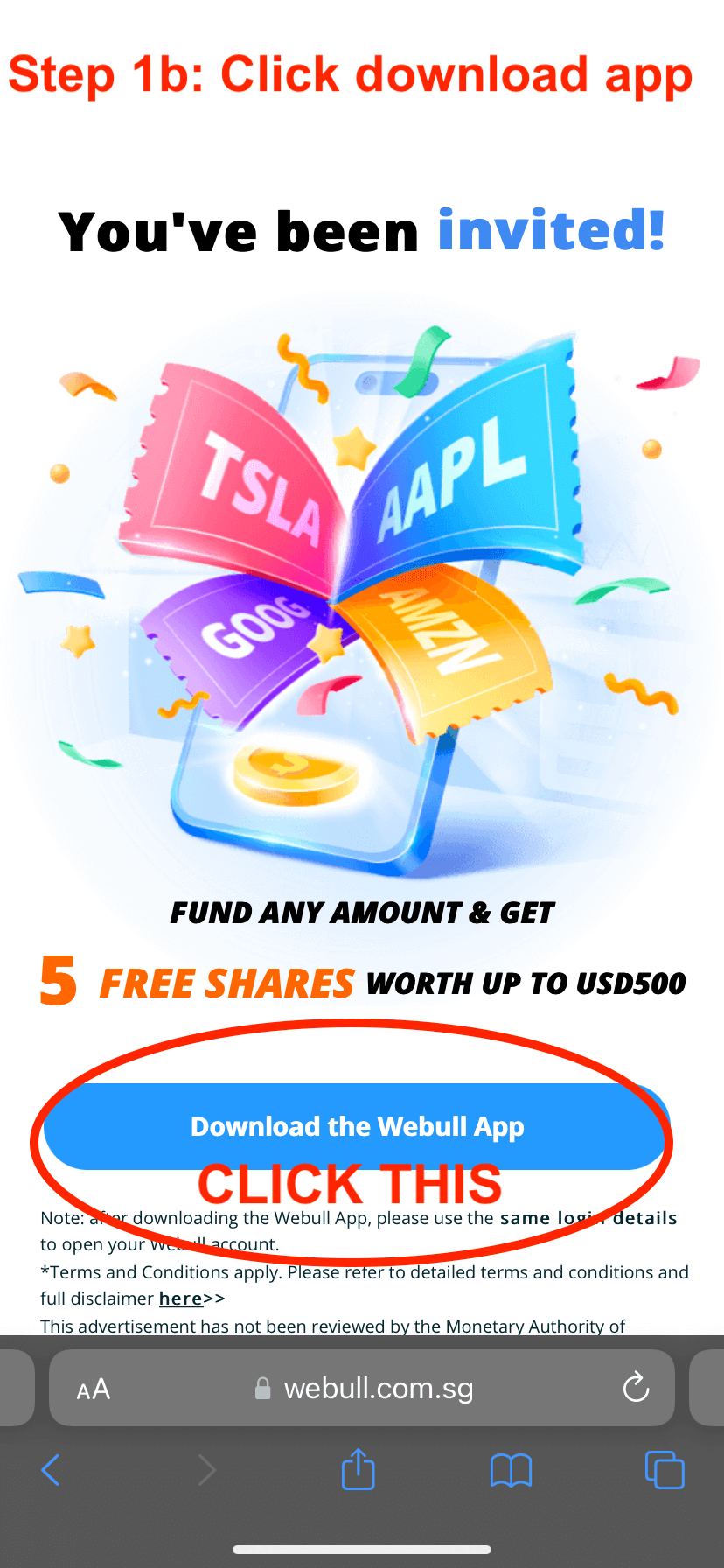

Should the withdrawal fail, you can check the message board to find out the error. (Go to “Menu” tab found at the bottom right -> In the Message board scroll down to see “Account Manager (Webull SG)” where they will update the error. (See image below)

The most common error is when the bank account number in your screenshot does not match the bank account number you input into the field.