#1: CLICK ON THE BUTTON BELOW TO SETUP YOUR ACCOUNT WITH Plus500.

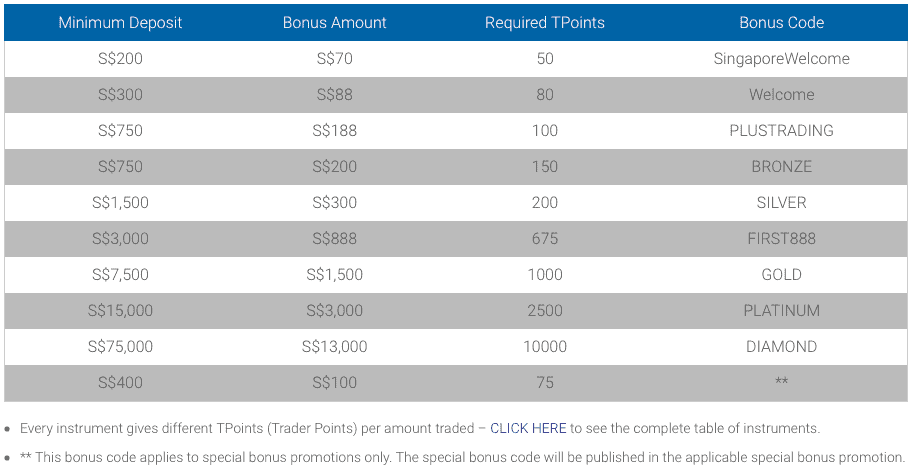

Sign Up Welcome Bonus

Remember that CFDs are a leveraged product and can result in the loss of your entire capital. Trading CFDs may not be suitable for some investors. Please ensure you fully understand the risks involved.

Plus500SG Pte Ltd (UEN 201422211Z) holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products (License No. CMS100648).

#2: Introducing Plus500!

Plus500 Ltd was founded in 2008, and is located in Israel. The offices in the UK, Australia, Singapore, and Cyprus are subsidiaries. They specialize in offering a wide range of CFDs for stocks, ETFs, options, Forex, and other instruments. While leveraged trading provides opportunities to increase gains and trade with minimal capital, it also carries the risk of amplified losses. Plus500 prioritises user-friendly interface and limited advanced functionalities that more seasoned investors might seek.

Here are the key points about Plus500:

- Product Summary:

- Offers CFDs on various assets: shares, ETFs, options, Forex, indices.

** Do note that the CFDs can only be traded on the Plus500CFD platform. - Plus500 Invest Platform: Plus500 had launched an Invest Platform! The platform provides share dealing with over 2,700 financial instruments, FREE market data, and dedicated round-the-clock customer support.

*Plus500 Invest is currently available in certain countries. Plus500 Futures: Plus500 Futures by Plus500 is an innovative and easy-to-use trading app for Futures Trading. With cutting-edge tech, professional support, and reliable clearing services, users can trade on E-mini and micro Futures contracts.

* Available for US traders!

- Offers CFDs on various assets: shares, ETFs, options, Forex, indices.

- Zero Fees For:

- Real-time forex quotes

- Dynamic charts & graphs

- Live share CFD Prices

- Opening / Closing trades

- Rolling your position

- No withdrawal and deposit fees.

* Unless it is determined and levied by your payment issuer or bank, and not by Plus500.

E.g. for international card transactions, incoming/outgoing bank transfers and transactions using a currency that is not supported (Forex conversion)

- Additional Fees For (depending on your trading activity):

- Overnight Funding:

An overnight funding amount is either added to or subtracted from your account when holding a position after a certain time (referred to as the “Overnight Funding Time”). You can read more about this here.

- Currency Conversion Fee:

Plus500 will charge a Currency Conversion Fee for all trades on instruments denominated in a currency different to the currency of your account. The Currency Conversion Fee will be reflected in real time into the unrealised profit and loss of an open position. You can read more about this here.

- Guaranteed Stop Order:

A unique order type used to help you manage risks by guaranteeing the stop loss level. If you choose to use this feature, please note that as it guarantees that your position closes at a specific requested rate, it is therefore subject to a wider spread. You can read more about this here.

- Inactivity Fee:

A fee of up to USD 10 per month will be levied, should you not log in to your trading account for a period of at least three months. This fee will be charged once a month from that moment onwards, as long as no login is made to the account.

- Overnight Funding:

- How is Plus500 compensated:

Plus500 is compensated for its services through the Buy/Sell (Bid/Ask) spread (click here to learn more about this), so when you open a position, you essentially “pay” the spread. This spread is incorporated into the Plus500 quoted rates and is not an additional charge or fee payable by you above the quoted rates. To view the spread for a specific instrument, simply:

- Log in to your account.

- Search for a specific instrument.

- Click on the Details icon (i) and scroll down to the Info section.

- Licensing:

- The Plus500 Group holds 12 regulatory licenses across different jurisdictions including Singapore (MAS), Australia (ASIC), and the UK (FCA) via its subsidiaries.

- Provides a user-friendly platform for online trading.

- Focuses on transparency and regulatory compliance.

- Offers a wide range of investment options for diversification.

- Encourages active trading and discourages prolonged periods of account inactivity.

#3: What fees and charges should you be aware of? !

While trading with Plus500, you can expect a minimal number of fees and charges. The brokerage primarily derives its revenue from margin spreads imposed on specific trades. However, there is no need for undue worry, as Plus500 offers competitively priced spreads.

It’s important to note that if you engage in trading with a currency other than the Singapore Dollar, you should be mindful of potential currency conversion fees.

Furthermore, if your account remains inactive for three consecutive months, an inactivity fee of up to US$10 per month will be applied to your account.

#4: Pros of Plus500

Point #1: User-Friendly Design

One standout feature of Plus500 is their dedication to ensuring a user-friendly trading experience; and the minimal service charges and fees by Plus500 make it more cost-effective for users. This is particularly crucial as Plus500 specializes in trading Contracts for Difference (CFDs), which involve leverage and can lead to rapid gains or losses.

However, it’s worth noting that while Plus500 prioritizes user-friendly interface, it may have limited advanced functionalities that more seasoned investors might seek.

Point #2: Competitive Spreads and Minimal Fees

Plus500, like other CFDs brokerages, generates its revenue primarily from margin spreads, which generally align with market standards. This positions Plus500 as a competitively priced brokerage. Additionally, the advantage of choosing Plus500 is the limited number of fees you will encounter, as long as you maintain an active account. This further contributes to the brokerage’s reputation for providing cost-effective trading solutions.

Point #3: Trustworthy Brokerage Listed on the London Stock Exchange

Plus500 is a highly reputable company. The Plus500 Group holds 12 regulatory licenses across different jurisdictions including Singapore (MAS), Australia (ASIC), and the UK (FCA) via its subsidiaries. Adding to its credibility, Plus500 is listed on the prestigious London Stock Exchange. Notably, the Plus500 Group achieved a significant milestone with a record number of active customers during the first quarter of the year, further demonstrating its trustworthiness and popularity among traders.

#5: Who is Plus500 best suited for?

Plus500 is an ideal platform for those seeking a user-friendly and intuitive trading experience, with a diverse selection of financial tools at their disposal. Additionally, Plus500 offers the advantage of an unlimited free demo account, allowing users to practice their trading strategies without any limitations.

Plus500’s emphasis on minimal service charges and fees make it more cost-effective for users. This means that the cost of trading is primarily focused on actual trades, making it more cost-effective for users.